Good morning . In my second blog dated 16/09/2023 I discussed about status of a person which is basically dependent upon stay in India and is covered by Section 6 of the Income Tax Act 1961.

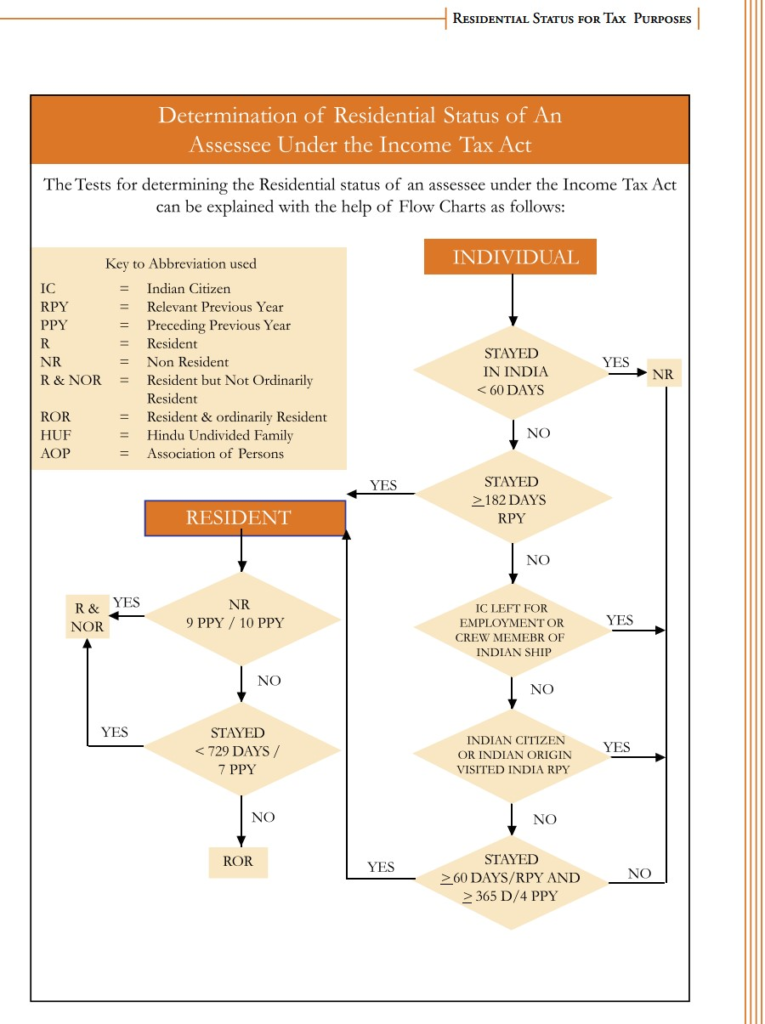

Though I tried to explain section wise but during some study I found a chart which explains the stay in a very simple manner vis a vis status of a person for each year for furnishing the income tax return;l

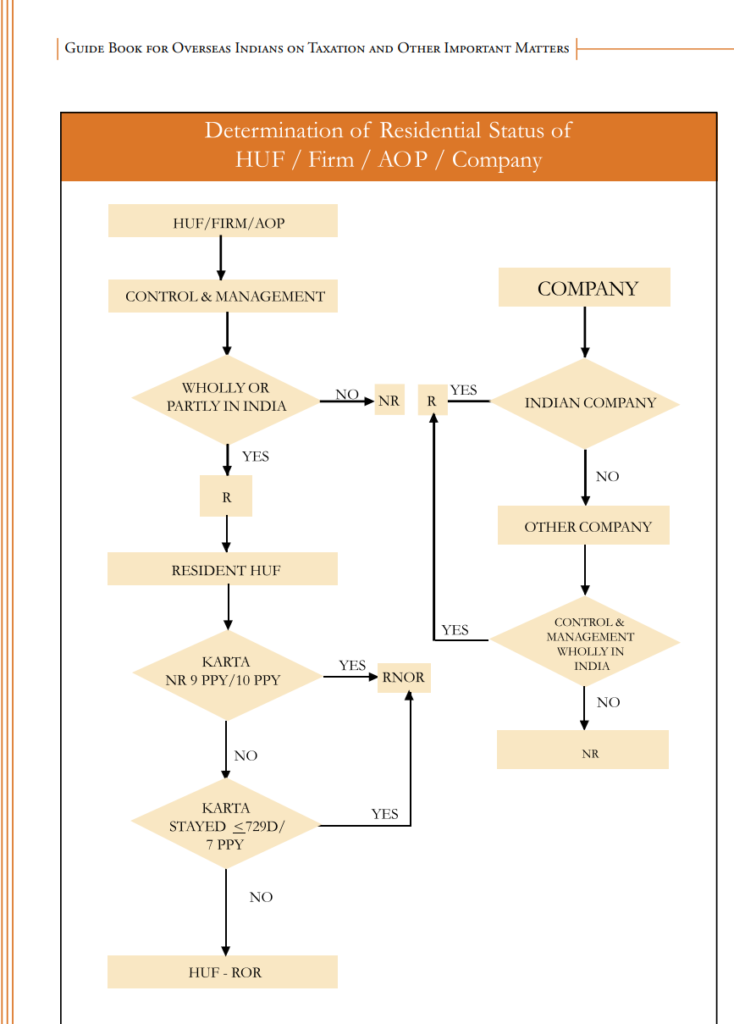

First chart explains the criteria for individuals and the second chart is in respect of Hindu Undivided Family and Company which are as under:

These charts will give a clear picture and understanding on the subject. If any clarification is required, you are most welcome to write on my Blog or Email ID.

In my next Blog I will discuss the provisions of DEEMED RESIDENT inserted wef Asstt Year 2021-2022.

Thanks

Vijay Bansal